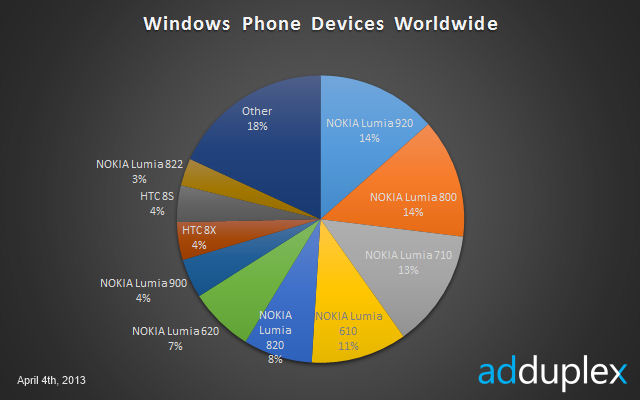

The data for the global device breakdown shows that Nokia continues to be dominant, taking all seven of the top device slots, and eight of the top ten. The Nokia Lumia 920 is the most common device, an impressive achievement after just 4 months of sales, and indicative of rapidly growing sales of Windows Phone 8 devices.

The Nokia Lumia 620 also looks to be selling well. It now accounts for 7% of devices, up from 2% last month. This is a pattern we expect to see repeated with the Lumia 520 and 720 in subsequent months.

It's worth emphasising that AdDuplex can only track devices where an app with its advertising SDK embedded is being actively used. This means high end devices, such as the Lumia 920 and HTC 8X, tend to be over represented in such data sets because owners of these devices are more likely to install apps.

Image Source: AdDuplex

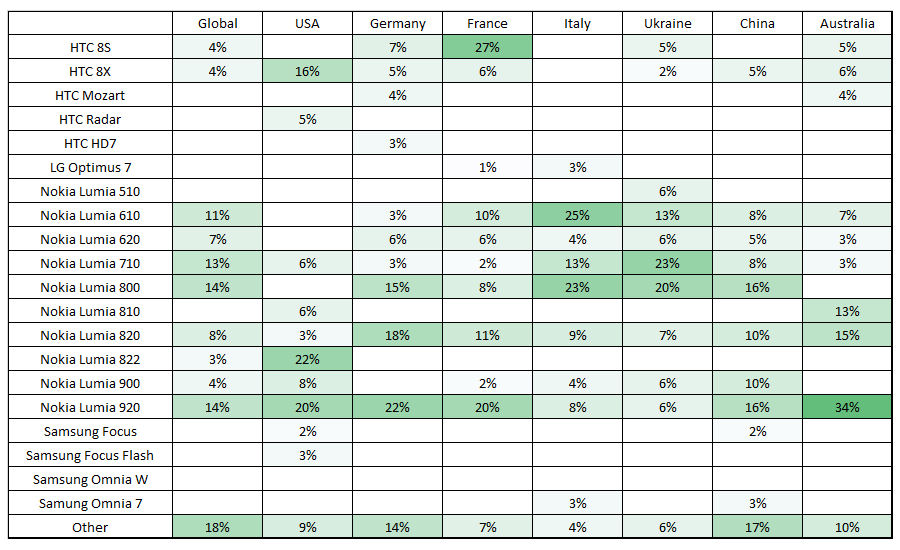

AdDuplex also provides device breakdown data for a number of other countries, which we have collated into a table below. With a few notable exceptions (HTC 8S in France and HTC 8X in USA) all the dominant devices are from Nokia.

The data also suggest that the Lumia 920 is generally more popular than the Lumia 820 in most markets, perhaps suggesting the positioning gap between the two devices is too small (i.e. people do consider the 820 cost saving significant when measured against lower specification / features).

The prevalence of low and mid-tier devices (Lumia 610, Lumia 620) in volume measurements is not surprising, but there is noticeable variation between countries. The Ukraine and Italy are example of markets where cost sensitivity appears to be higher than in other markets (likely to do with the way phones are sold and the level of subsidy).

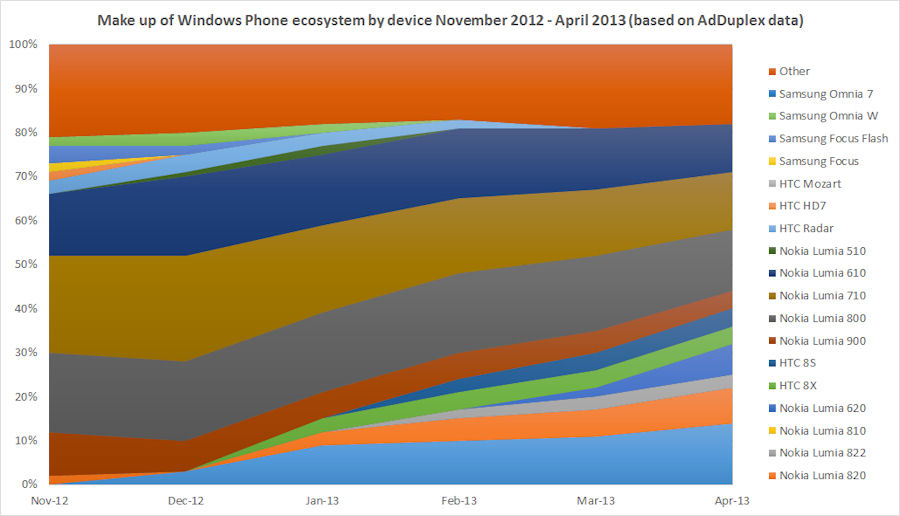

AdDuplex has now been reporting data for six months, which let us see the changing nature of active devices in the Windows Phone ecosystem over time. The most obvious changes occur when new devices go on sale, but also notable is the fall off in Samsung devices in the last six months, something that has firmly established HTC in second place in the Windows Phone manufacturer rankings.

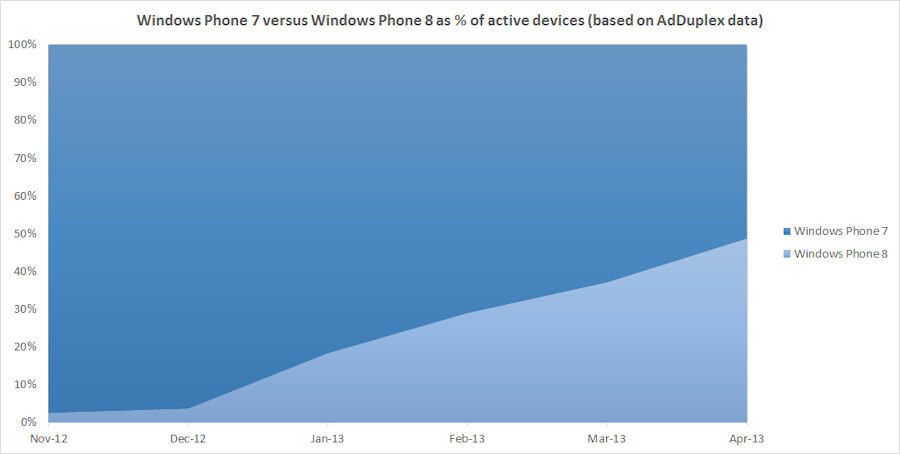

Breaking the devices down into Windows Phone 7 and Windows Phone 8 groupings (and ignoring the other categorisation) we can see the increasing volume of Windows Phone 8 devices in the active installed based over time. As of April 1st AdDuplex report that Windows Phone 8 make up 43% of active devices.

This rapid rise for Windows Phone 8 as a proportion of the active installed base is interesting for developers considering whether to target Windows Phone 7.5 devices. It is clear that Windows Phone 8 devices will very shortly outnumber Windows Phone 7 devices, offering justification for a Windows Phone 8 only strategy. Of course, ideally a developer will target all devices in order to access the biggest addressable market, but time and cost factors may not allow for this.

You can read the full report on the AdDuplex blog.