Inevitably, given the close working relationship, the two companies meet frequently at all levels, something pointed out by a Nokia spokesperson in response to the Wall Street Journal. However, given the non-denial statement by Nokia and the source of the original report, it is not unreasonable to assume that talks have taken place.

Such talks could be around an acquisition, but other options might also be on the table, such as Microsoft taking a stake in Nokia, as it did with Apple in the late nineties. An alternative option would be the modification of its current Windows Phone licensing deal with Nokia. Microsoft has been making platform payments to Nokia to offset some of the costs associated with switching to Windows Phone, while Nokia has been making software license payments to Microsoft. As a result there has been a net flow of money from Microsoft to Nokia. However, this flow is set to be reversed in the second half of 2013, as total licensing payment increase with device volume, and the platform payments come to and end.

Acquisition and pricing

Nokia has been the rumoured acquisition target of multiple companies, most recently Huawei, but a widely perceived stumbling block is the presence of Microsoft as a third party. Anyone making a bid for Nokia would need to consider the strong possibility of counter bid from Microsoft, given the strategic importance of the relationship between the two companies.

That any potential acquisition would stumble over pricing is not surprising, especially in the case of Nokia. Putting a price on Nokia is difficult because its recent relatively poor performance has to be set against longer terms assets, such as its intellectual property portfolio, brand, and human capital. Nokia's current market capitalisation is just over €11 billion and the company reported revenue of just over €30 billion last year, of which about half came from its devices and services division.

Motorola Mobility, which provides some basis for comparison, was Google acquired in May 2012 for $12.5 billion (€9.4 billion). Motorola Mobility had a capitalisation of around $7.3 billion (€5.5 billion) before news of the acquisition broke, with reported revenues of just over $13 billion (€9.8 billion) for 2011. Some industry analysts feel that Google overpaid for Motorola Mobility, but Nokia would almost certainly command a similar, and perhaps even greater premium, especially as many of its shareholders feel the company is undervalued.

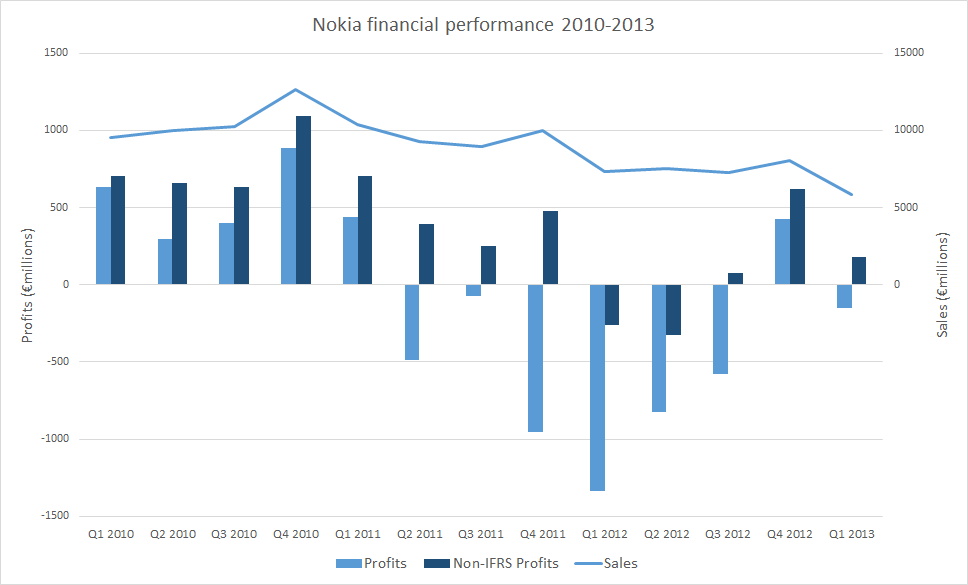

Nokia has begun to improve its financial performance around, with only a small loss (€150 million) reported in Q1 2013 and non-IFRS figures (underlying performance) showing a small profit (€186 million) and a stable cash position (€4.5 billion, up €120 million from the previous quarter). The improved performance arguably makes Nokia less vulnerable to an acquisition, but its relatively low market capitalisation, especially measured against its cash and other assets, means than an acquisition remains a reasonable possibility.

Nokia's device volumes are a concern, with the last quarter seeing a sharp decline in the sale of mobile phone devices (55.8 million units, down 21% year on year) and smartphone volumes of 6.1 million units. Mobile phones sales should recover somewhat in the second quarter, but the long term trend is downwards as mobile phone users move to smartphones. Nokia's smartphone volumes are expected to grow in Q2, with Nokia indicating it expects at least a 27% quarter on quarter growth, which would indicate smartphone sales of more than 7 million units in the second quarter of the year. The ultimate fate of Nokia will depend on maintaining a healthy financial performance, while also growing sales device volumes.