The concept of an 'installed base' of smartphones is something I've looked at before, but the idea reared its head when I looked a few days agi at the near simultaneous launch of the hit game Tennis in the Face on iOS, Android... and Symbian. In other words, its all very well thinking about current 'market share', i.e. the numbers of smartphones selling at the moment, but what of all of those that have sold in the last two, or three, years? These devices will still be in use and available for purchasing applications and accessories, their users will still be looking for software reviews, tips and tutorials, and so on.

So, when we talk about smartphone platforms, it's important to factor in the active installed base rather than just what's trendy this month, this quarter. The big question, of course, is how far do you go back in a platform's history before you find a majority of devices sitting unused and unloved in a drawer?

Let's take a generous definition first, considering all devices less than three years old as making up part of the active installed base. It's true that some of these phones may well have already been replaced and might be unused, but equally well, there will be devices older than three years which are still in use, balancing out the former factor.

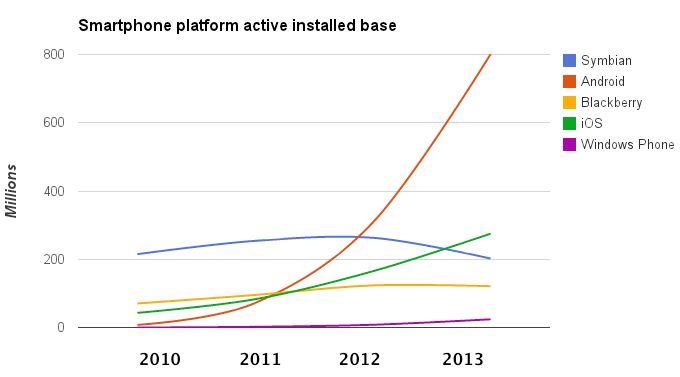

Using data compiled from Gartner, IDC and Canalys, and with the chart lines smoothed slightly, I've done the calculations. Here then are the trends in active installed base for the five major smartphone platforms:

The rise and rise of Android (red) is nothing but dramatic, of course. Symbian (blue) was the incumbent in the smartphone world, but the number of active Android-powered devices matched the number of Symbian handsets in active use early in 2012 and Android is now utterly dominant. iOS phones (green, i.e. the iPhone range from Apple) saw their active installed base also match Symbian's late in 2012, though the rate of growth isn't as dramatic as Android's.

The rise and rise of Android (red) is nothing but dramatic, of course. Symbian (blue) was the incumbent in the smartphone world, but the number of active Android-powered devices matched the number of Symbian handsets in active use early in 2012 and Android is now utterly dominant. iOS phones (green, i.e. the iPhone range from Apple) saw their active installed base also match Symbian's late in 2012, though the rate of growth isn't as dramatic as Android's.

We hear a lot about 'ecosystems', of course, effectively meaning the same as 'platform', though with more of a leaning to business and application sales rather than technical compatibility. What the above chart demonstrates is that, perhaps surprisingly in the light of recent tech trends, Symbian is still in third place in terms of mobile platforms, and by quite a margin. Blackberry, in fourth, is within sight, but that platform has been dying in terms of sales at similar speed to Symbian and it's not clear yet whether the new re-launch, with Blackberry OS 10 will be a success. Meanwhile, Windows Phone, by far the newest mobile OS, is left with a comparatively tiny active installed base of users, showing how far that platform has to go before you start seeing Windows Phones on every bus or train.

One criticism which you might level at me is that three years is perhaps too conservative in terms of allowing devices to be considered as still 'active'. After all, a phone which isn't on contract anymore (e.g. after a typical 24 month agreement is up) is likely to be passed on or handed down to another family member, who may not be as active in terms of interacting with the ecosystem as the original owner. I'm sure we all have tales of passing on a smartphone to a wife or child or parent and then seeing it basically serving as a glorified feature phone.

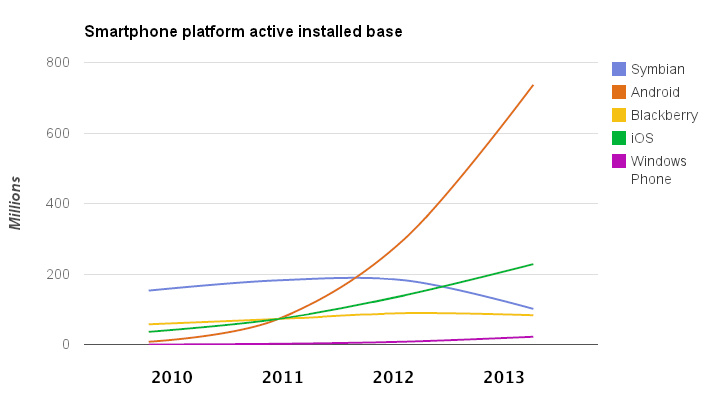

With this in mind, let's do the same calculations, but based around a two year integration period instead. In other words, every device over two years old is automatically excluded, at each point. This is definitely on the aggressive side, since I'd wager a lot of phones do get used seriously outside this period, but the numbers are still worth looking at:

In fact, aside from Symbian's installed base dipping a little more sharply (without the big sales numbers from 2009/2010 to bolster things), the chart remains very similar, proving that the exact definition of 'active' doesn't make that much difference when looking at each platform's installed base. Symbian, even with this aggressive definition, is still clearly in third place, ahead of the also declining Blackberry.

In fact, aside from Symbian's installed base dipping a little more sharply (without the big sales numbers from 2009/2010 to bolster things), the chart remains very similar, proving that the exact definition of 'active' doesn't make that much difference when looking at each platform's installed base. Symbian, even with this aggressive definition, is still clearly in third place, ahead of the also declining Blackberry.

In fifth place then, is Nokia's chosen 'new' platform. The numbers/curve for Windows Phone are, of course, identical, since the platform is still relatively new, though the upside of this is that the installed base number is, by definition, only going to be rising for a while.

The question then is how long might it be before Windows Phone becomes the fabled 'third ecosystem' by my active installed base metrics? The numbers in my spreadsheets imply that this could happen by the end of 2013, since the fall in the active installed base for Symbian is statistically very predictable. For this to happen though, it does need Windows Phone sales to reach something in the region of ten to fifteeen million smartphones per quarter - this is quite achievable, given the platform's current acceleration.

The switch into third place also requires Blackberry 10 not to be a big hit, though as an impartial observer of that scene, I have to note that this is effectively a whole new, incompatible platform and perhaps we should be viewing that in the same way as Windows Phone (succeeding Windows Mobile, etc.) and starting to count its numbers from scratch?

In the meantime, raise a glass to the venerable Symbian OS, now in its 15th year and still, by some way, no matter what other tech commentators might write, the third most used smartphone OS on the planet.