For the manufacturers, there are two vital changes to Windows Phone in recent weeks that should make the platform more attractive.

The first is the licence fee that Microsoft will be charging. Now that Windows devices with screen sizes under nine inches do not incur a licence fee, that puts it comfortably alongside Android in the bill of materials. Yes there will be other considerations, such as patent licensing, testing, and carrier certification processes, but one of the biggest costs of software has been taken away at a stroke.

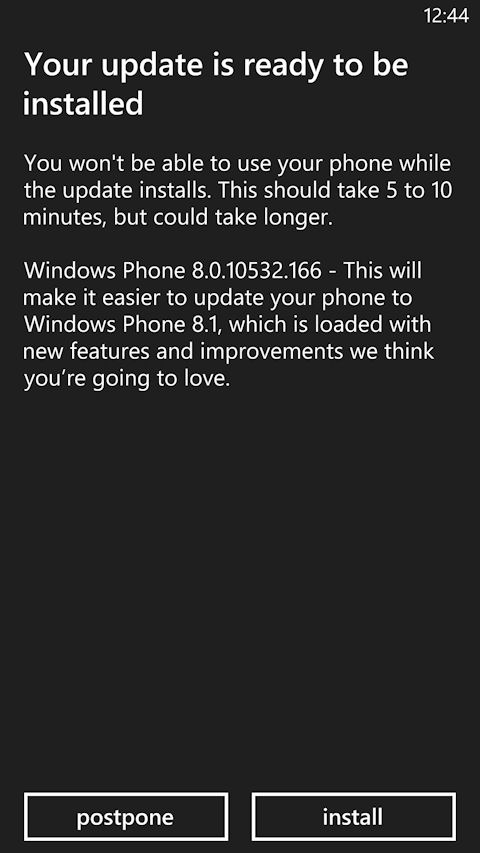

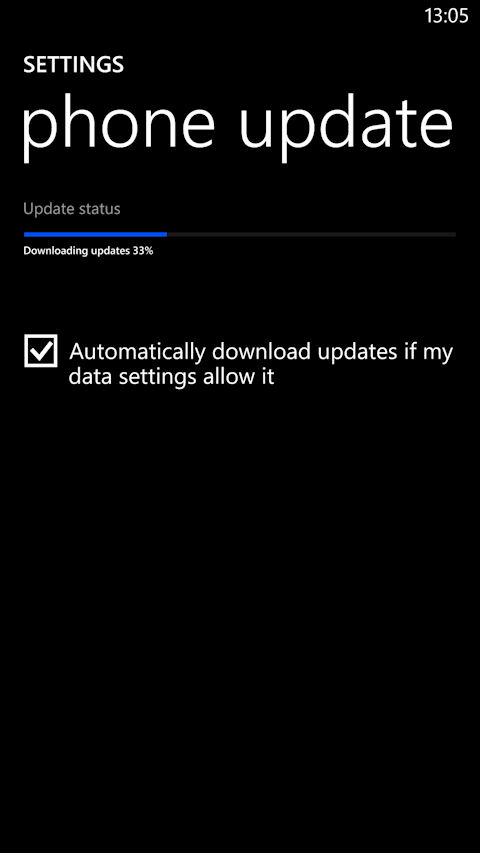

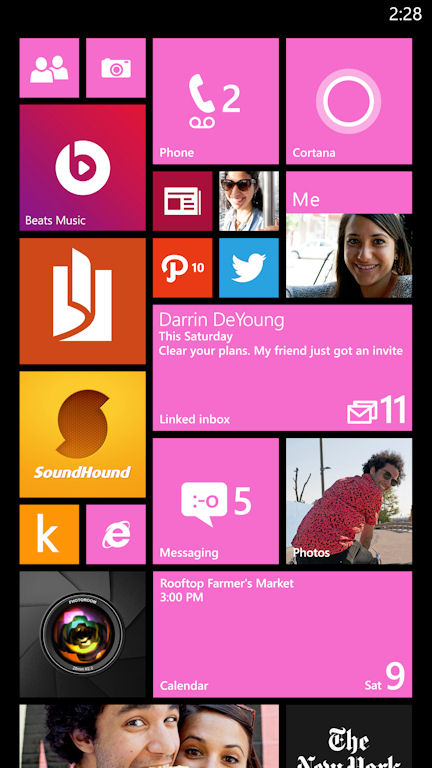

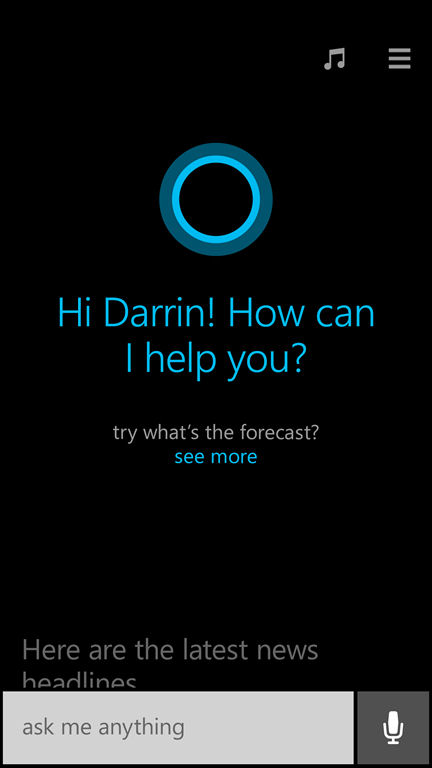

The update to Windows Phone 8.1 also brings a certain confidence in the platform. There are no obvious gaps in what a consumer would expect from a smartphone. You could probably cross your fingers and call Windows Phone "feature complete" this summer with the additions in the latest release.

Yes, there remains an app-gap, and it would be the matter of a few minutes to bring up a list of apps and web services to show which have Android versions but not Windows Phone versions (it would take seconds if you were to include games). In the same breath, you can easily call up services where iOS has the app and Android users are left bereft, just as Windows Phone users are. It's more of an issue for Windows Phone than Android, but as we've discussed here on AAWP many times before, it's far from the show stopper that it was 18 months ago.

The current smartphone landscape has solidified around three platforms. Apple is not going to be sharing the OS, so for many manufacturers their only realistic choice in the last few years has been Android.

This is where Microsoft has a shot. They are, comfortably, the third ecosystem. Standing atop the rubble of BlackBerry 10; with no clear path for upstarts such as Firefox OS, Ubuntu Mobile, or Sailfish OS, to gain traction; with a ten percent market share under its belt in quite a few markets; Windows Phone is the only challenger. And now it is a challenger that truly has a viable and attractive package.

That doesn't mean that the manufacturers are suddenly going to drop Android and flock to Windows Phone. However, with Google exerting more and more influence over the "open" platform that is Android (e.g. the licensed Google Play Services portion of the ecosystem, plus non-fragmentation clauses in the Open Handset Alliance membership agreements), manufacturers looking to hedge against a dominant Mountain View will be looking at the alternatives. Which is, essentially, Microsoft.

Windows Phone, clearly, is not a fork of Android, so manufacturers can adapt and release handsets running Microsoft's mobile operating system without risking their Android portfolio. We've seen this with Samsung and the announcement and release of the ATIV and Omnia handsets. I expect this to continue in 2014 and into 2015 as manufacturers look at the long term impact of the dominance of Google. Whatever changes to Android are announced at the upcoming Google I/O conference, I suspect many of those changes wiil be of more benefit to Google and the value from the changes will head back to the parent company, rather than the manufacturers.

That means there is going to be a little bit more of a corporate push in Samsung behind the ATIV range. It means HTC may well look at adapting the M8 hardware to run Windows Phone 8.1. It means that the rumours around Sony dabbling with a Microsoft powered mobile phone are likely to come true before Christmas. And many smaller manufacturers will be looking at that free licence, the Qualcomm reference designs, and decide to give WP a spin to see how it all works.

These handsets may not appear in huge quantities, they may not make it out of a handful of territories, and it is unlikely they will reach double-digit share of the Windows Phone market. But, they will all provide a manufacturer with knowledge and competency about the Windows Phone platform. They will allow Microsoft to educate the companies about the entire "One Windows" value proposition, and for companies such as Lenovo and Sony who already work with Microsoft in the laptop and tablet world, there's a lot of synergy that can be traded as well.

There's even a chance that one of them will prove to be a breakout hit and go global. And each handset will be a lever that can be used against Google in the long-term fight against Android dependency.

That means there's a very good chance that using Microsoft is a short-term measure and a manufacturer may return to Android. That's a gamble that Microsoft is willing to take, because (a) there's a good chance that it'll capture more users for its cloud services, which is a win in itself, and (b) one or two of the manufacturers might just get it right and have a hit on their hands.

And (c) is the destabilising effect on Google and Android, which would be very much welcome as Microsoft slowly grows into a modern cloud and services company.