The results are slightly behind analyst expectations, but an improvement on results from a year ago, which were themselves poor due a write down on the aQuantive acquisition. In its release Microsoft identifies the decline in the PC market as having an impact on its results, but notes strong demand for enterprise and cloud offerings.

“While our fourth quarter results were impacted by the decline in the PC market, we continue to see strong demand for our enterprise and cloud offerings, resulting in a record unearned revenue balance this quarter. We also saw increasing consumer demand for services like Office 365, Outlook.com, Skype, and Xbox LIVE,” said Amy Hood, chief financial officer at Microsoft. “While we have work ahead of us, we are making the focused investments needed to deliver on long-term growth opportunities like cloud services.”

Here's the break down for each of Microsoft's major divisions.

- Windows Division: revenue of $4.411 billion and profit of $1.099 billion.

- Server and Tools Division: revenue of $5.502 billion and profit of $2.325 billion.

- Online Service Division: revenue of $804 million and profit of $372 million.

- Business Division: revenue of $7.213 billion and profits of $4.873 billion.

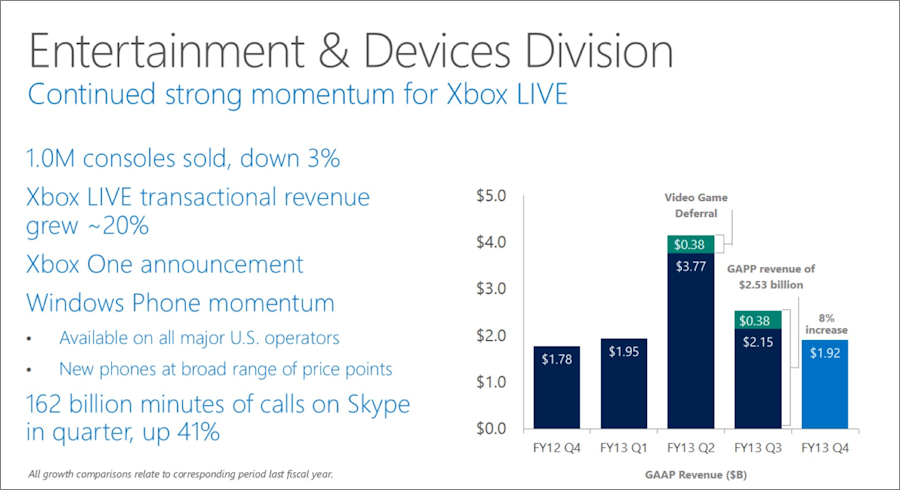

- Entertainment and Devices Division's (Xbox, Windows Phone and Skype): revenue of $1.915 billion and loss of $110 million.

Windows Phone

Windows Phone gets a brief mention in the results release, with a note that the $134 million (8%) increase in revenue in the Entertainment and Devices Division (EDD) was primarily due to higher Windows Phone revenue, offset by lower Xbox 360 revenue. Windows Phone revenue, which is a combination of patent licensing revenue and sales of Windows Phone licenses, is recorded as being $222 million.

The earnings presentation page for the EED division also notes Windows Phone momentum: "available on all major U.S. operators and new phones at broad range of price points":