Once more I find myself looking at the numbers to see where Windows Phone has reached a ten percent share. That's the point where, academically, the ecosystem becomes a 'major' player in the smartphone market.

Right then, some background on why this is important. This is an extension of the 'Economic Rule Of Three', postulated in 1976 by Bruce Henderson. A number of studies have been conducted on the rule (notably this one from 2002) and it has proven relevant to various markets, not just in consumer electronics.

What exactly does it say?

In competitive, mature markets, there is only room for three full-line generalists, along with several (in some markets, numerous) product or market specialists. Together, the three “inner circle” competitors typically control, in varying proportions, between 70 per cent and 90 per cent of the market. To be viable as volume-driven players, companies must have a critical-mass market share of at least 10 per cent.

There are two elements to pick out here: the idea of three leaders, and the idea of viability.

There's a reason why Microsoft and Nokia continually pushed the idea of the third ecosystem during the Windows Phone 7 days, and carried on with it in Windows Phone 8. This is it. Time and time again it was reiterated that Windows Phone would be third. The realisation that the platform could not catch Android or iOS (at least, worldwide - Ed) in the short or medium term was clear. Microsoft was aiming Windows Phone at the 'inner circle' handsets.

And that goal has been achieved. It's the second part that's causing a few more headaches.

Digging into the studies, you have the 'generalists' and the 'niche' devices. The generalists more often than not have reached the critical mass market level of ten percent. The niche players (which in the 2014 smartphone line-up is more than likely Blackberry, with Jolla's Sailfish OS and Firefox's open platform some way behind) sit between 'just off the bottom' and five percent.

If you are in the niche, you market as a niche product to your target audience. You can do rather well with this approach. If you're in the mass market field of ten percent or higher, then you market with a more general approach. The issue you have is if you are caught in the valley between five and ten percent.

On the higher side, you have increasing financial performance mostly due to volume and economies of scale. On the lower side you have better financial performance due to specialisation and delivering an almost customised experience. When the financial performance is analysed, there is no safety in mid-sized numbers for bulk orders, or for specialisation. The single worst place to be in terms of the health of a company, in any market, is in the 5-10% market share space.

Guess where Windows Phone is...

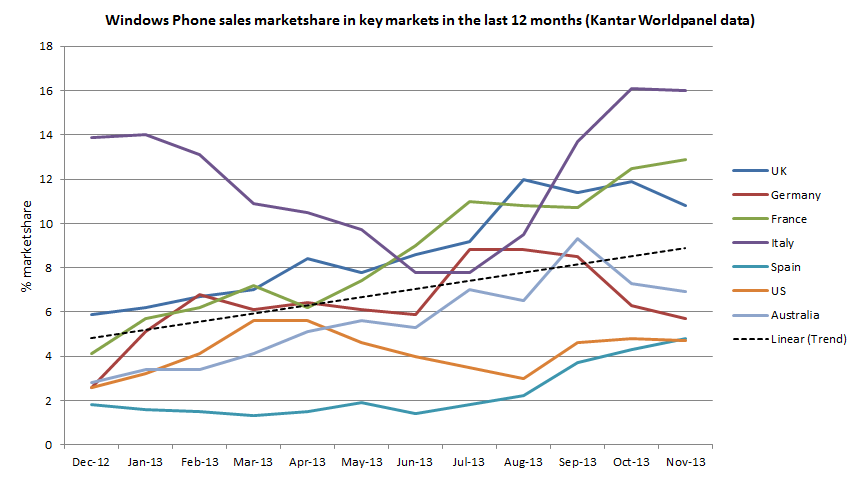

The latest data from Kantar Worldpanel on smartphone share in the US makes for better reading in this regard than the last few surveys, but there is still a worrying gap. You can probably guess where it is. Windows Phone is now on 5% of the market. It is set to leave niche territory, but not yet ready to be a volume player in the US market. While the platform makes its sojourn through the valley, the financial performance of the players involved is going to take a hit. Presumably this is going to be all on Microsoft's balance sheet given the upcoming purchase of Nokia's Devices and Services section, so expect 2014 to have a number of scare stories in the press on the under-performance of Windows Phone and the 'failure' of the former Nokia later in the year.

It's a different story in Europe, where Windows Phone retained 10% in the five major markets (the EU5), with Italy, France, and the United Kingdom comfortably over the 10% mark. Germany (5.7%) and Spain (4.8%) are as problematic for Europe as the United States. That leaves pan-European marketing with the issue of niche vs. general once more.

That is why, even though Windows Phone during 2013 has confirmed its role as the third ecosystem, I'm watching the share numbers very closely. To gain the growth that many analysts believe Windows Phone can make (to reach between 16% and 20% share by 2018), there needs to be a well constructed and well implemented marketing strategy from Microsoft and all the partners involved. The message needs to be one designed around a 'volume driven' general approach and not a niche approach.

The territories where the platform has not reached 10% need the focus in the first half of this year so they can reach that status, and then the marketing fun and games can really begin and Windows Phone can start to work towards accelerating growth.

Until the 10% threshold has been breached across the board, Windows Phone is fighting with one niche arm tied behind its back, and that's not going to be helpful for anyone.