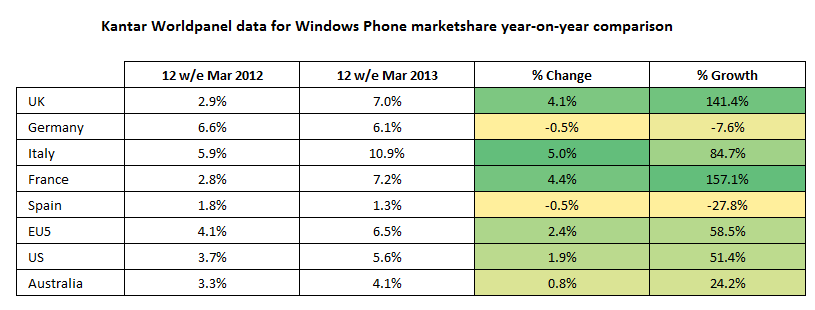

Windows Phone is still a small player compared to iOS and Android (19.4%, 68.8% and 6.5% in the EU5 respectively), but is now firmly in third place ahead of Blackberry and other competing platforms and is showing strong positive growth. Kantar Worldpanel reports its data as a percentage market share of sales in the preceding 12 weeks (i.e. a three month moving average). The data is drawn from a continuous survey methodology, where consumers are interviewed and consumer behaviour recorded.

The full Kantar Worldpanel data for March 2012/2013 is available here.

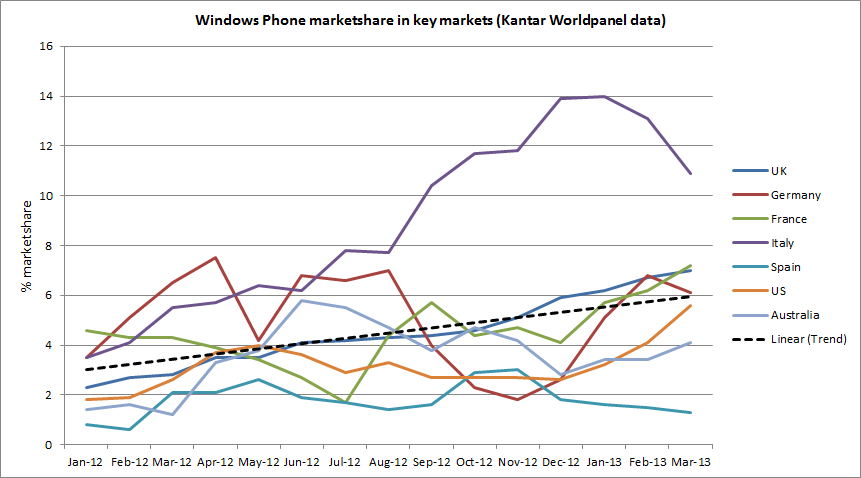

According to the latest set of Kantar Worldpanel data, Italy is the strongest market for Windows Phone out of the EU5 with market share for the 12 weeks ending February 2012 at 10.9%. Italy is followed by France (7.2%), the UK (7.0%), and Germany (6.6%). The average for the EU 5 is 6.5% (average of previously mentioned countries plus Spain at 1.3%).

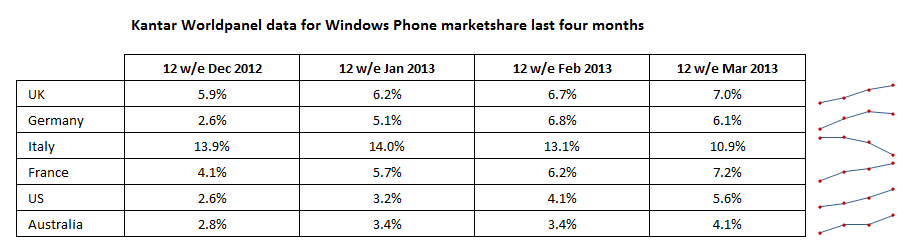

The number for the UK and France are particularly interesting as these are two of the markets that saw Nokia's mid range Lumia 620 go on sale in mid February (i.e. half way through the reporting period for the latest set of data). The growth in these markets may be an early sign of the impact of Nokia lower cost Windows Phone devices (Lumia 520, 620 and 720).

As we have previously commented and as can be seen in the chart below market share data, which shows Kantar Worldpanel market share figures for Windows Phone from the last fourteen months, there is significant variation from month to month, even with the smoothing effect of a three month moving average. This is because, within a given market, sales volumes of mobile phones are volatile, subject to peaks and troughs in response to handset launches, promotional activity, and price changes. For example, the rapid rise for Windows Phone in France in the latest report is due to sales of the competitively price Nokia Lumia 620 on a number of French operators.

In its press release Kantar notes that Windows Phone is showing continued growth:

Windows share growth has continued to rise in European markets, particularly where Windows is supported by the legacy of its hardware partners. The US market differs in the fact that there are still many users in the market that are yet to upgrade to their first smartphone device. And Windows is starting to capture these consumers.

“Windows strength appears to be the ability to attract first time smartphone buyers, upgrading from a featurephone. Of those who changed their phone over the last year to a Windows smartphone, 52% had previously owned a featurephone. Comparatively, the majority of iOS and Android new customers were repeat smartphone buyers, with 55% of new iOS customers, and 51% of new Android customers coming from another smartphone. While the differences between these figures are small, with over half of the US market still owning a featurephone, it’s likely that many will upgrade over the coming year, which will ultimately contribute to more growth for the Windows brand.” Parlato continues.

One of Windows’ key handset manufacturers, Nokia, has seen the greatest benefit from the OS’ growth. Although, still only 4% of smartphones sold in Q1 2013, Nokia has seen its share rise from just 1% in the same period a year ago.

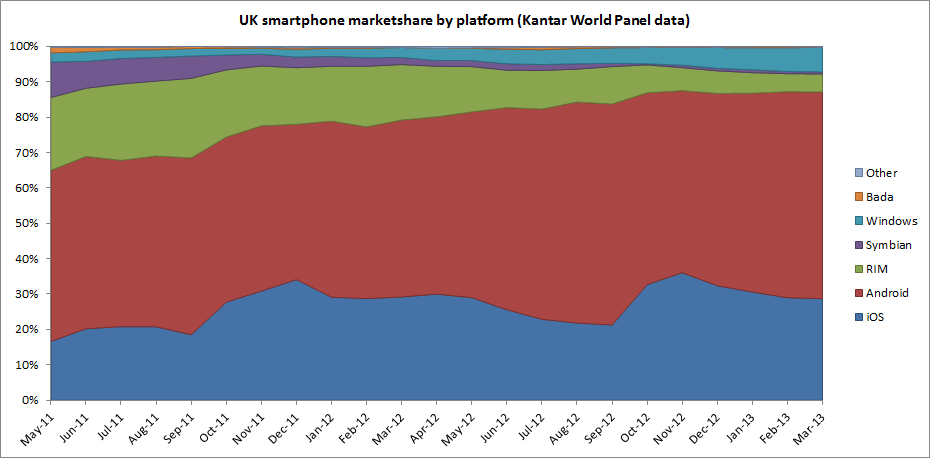

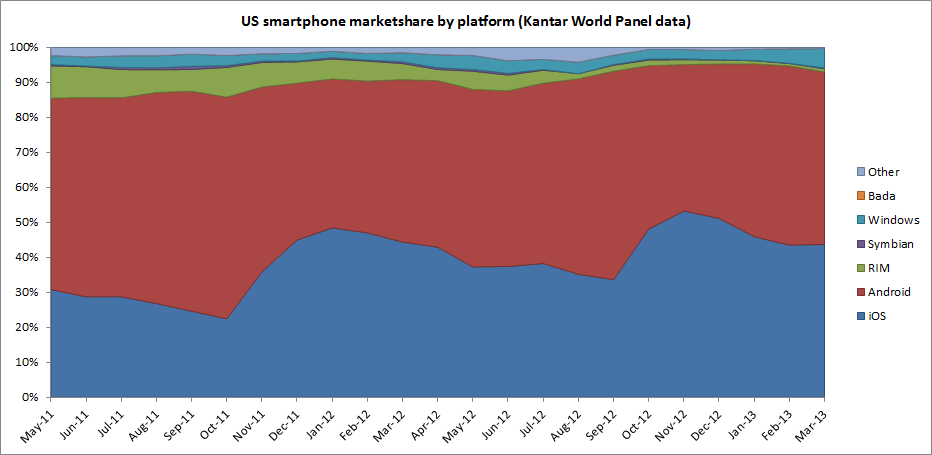

In the context of the overall smartphone market Windows Phone remains a relatively small player, eclipsed by both Android and iOS, as the charts below show. The strength of Windows Phone varies from market to market, but in the key UK and US markets the platform has firmly established itself in third place.

Windows Phone is the fastest growing platform, but that's a rather meaningless statistic given the small base from which the comparison is being made. Nonetheless its growth in market share over the last year (e.g. from 4.1% to 6.5% in the EU5) is a healthy sign, especially when you consider that three quarters of the growth (4.7% to 6.5% in the EU5) has come in the last four months (i.e. since the launch of Windows Phone 8).