Review: Monetal

Score:

74%

Personal money management applications. I know them well. I even wrote the manual for one of the world's best, back in late 1990's. I've reviewed many since then and yet, despite having four separate accounts, I've never - to this day - ever managed to get to grips with using an application to help me keep things tallied up. Can Monetal on Windows Phone help? Not really - but it's a polished attempt.

Buy Link | Download / Information Link

The problem, you see, is that money management is complicated enough in the real world - multiple accounts, standing orders, direct debits, credit cards, NFC cards, debit cards, cash, PayPal, all coming and going on a daily basis. Armed with a computer or a smartphone, most of this can now - thankfully - be managed and manipulated directly.

Back in the 'old days', the first you really knew about the inner undulations of your bank accounts were the paper statements that arrived in the post each month - and you'd then pore over them, checking transactions against your bills and cheque book stubs. And, with the advent of personal computers and even palmtops/PDAs, what better way to try and improve things than to keep track of income and expenditure on your electronic brain. At least you can some visibility into where your money was going and could plan and budget accordingly.

But these days you can see instantly in an online banking application or mobile web site what's going on, you can adjust payments, and so on. All in real time. So why would anyone want to keep a totally separate, manually-maintained ledger of each account and each transaction? One that required significant effort to update every time money was spent or scheduled? Why spend time on a facsimile that's almost certain to be inaccurate to some degree when you can manage the real thing?

Why indeed, and the answer is almost certainly that you wouldn't. Of course, nothing is black and white and there are some mitigating factors. For starters, not that many banks have fully working Windows Phone clients (and a few less in the USA after this week's news). Then there are applications like Monetal here, which offer a degree of categorisation - whereas your bank accounts are 'flat' in terms of all transactions being equal in scope - potentially giving you insight into spending and habits.

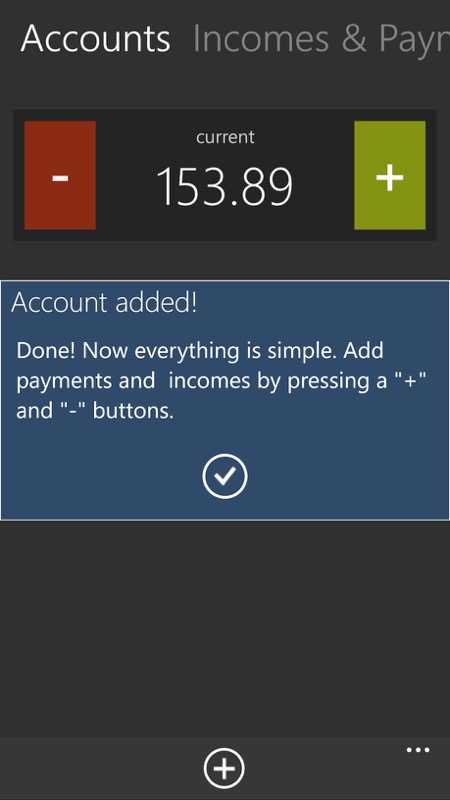

So it's onto Monetal with all the above caveats and considerations - and the trip is worthwhile since the developer has put significant effort into a dynamic and easy to use interface, going slightly beyond the usual Windows Phone guidelines. Here's a brief walk-through:

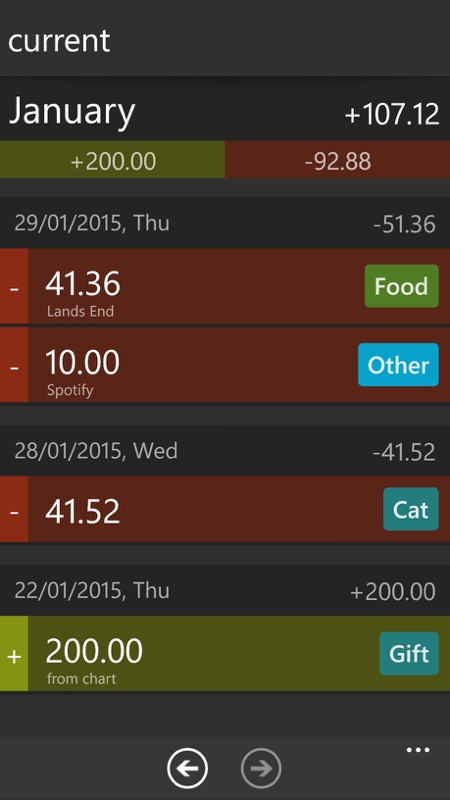

The UI is timed, in that the touchscreen is 'active', with pop-ups to help at first, entries which 'set' themselves after a certain number of seconds, detection of long pressing categories, and so on. It's all quite slick; (right) having got going with some credits ('+') and debits ('-'), it's easy to tap through to see monthly breakdowns of transactions within a given month, colour coded and with categories showing.

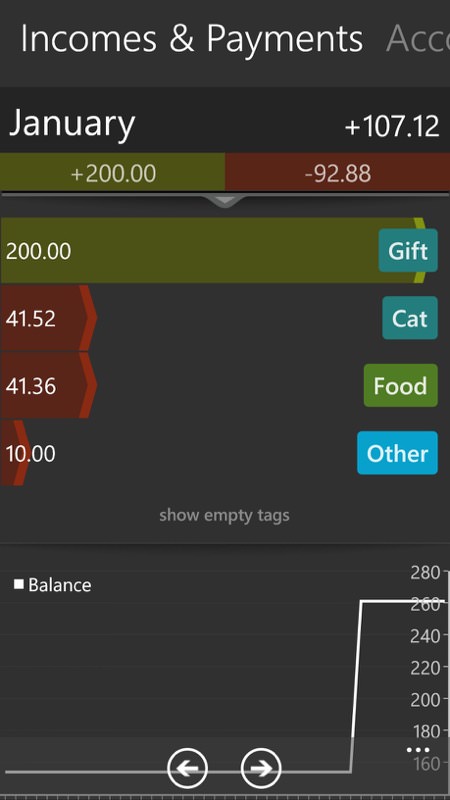

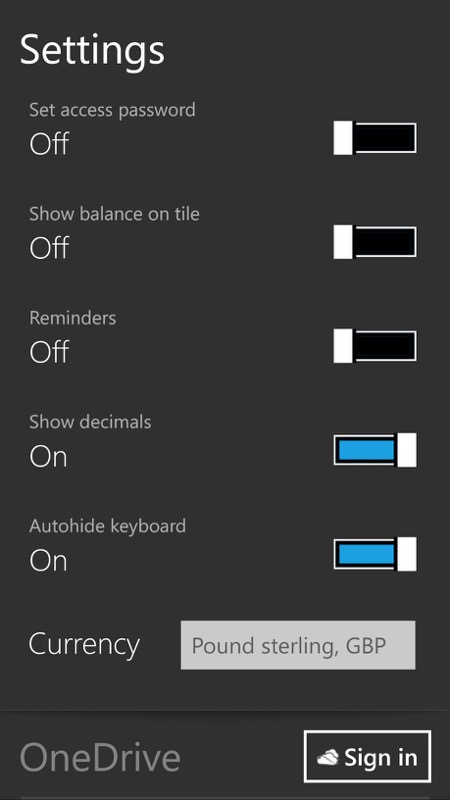

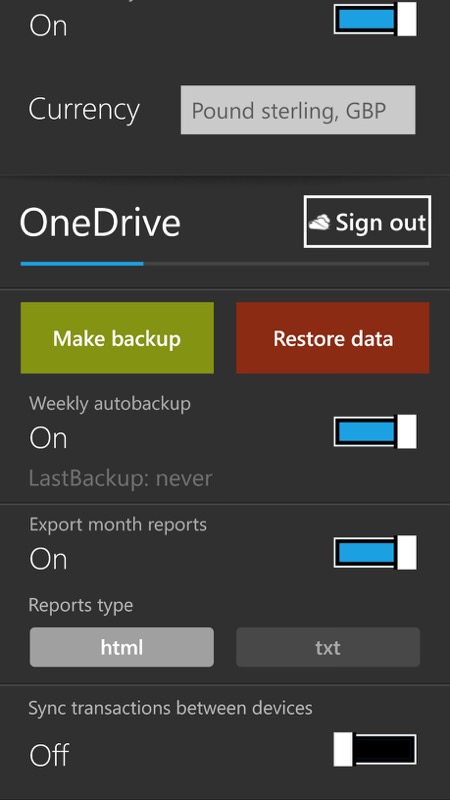

The categories themselves can be summed (under the over-arching 'incomes and payments'), with some very nice graphical ideas and aids; (right) the Settings section is impressive, with quite a bit of customisation and extra functionality.

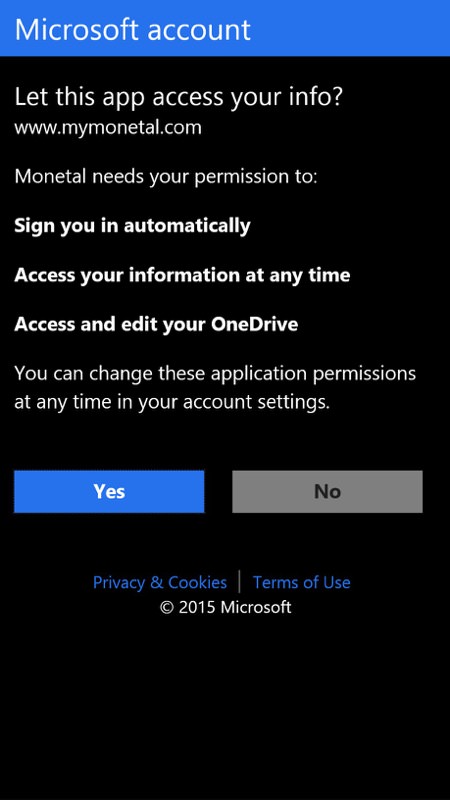

I was very glad to see an integrated way of backing up all this monetary data to the cloud, even more that this can be automated - essential if this type of tool is to be recommended.

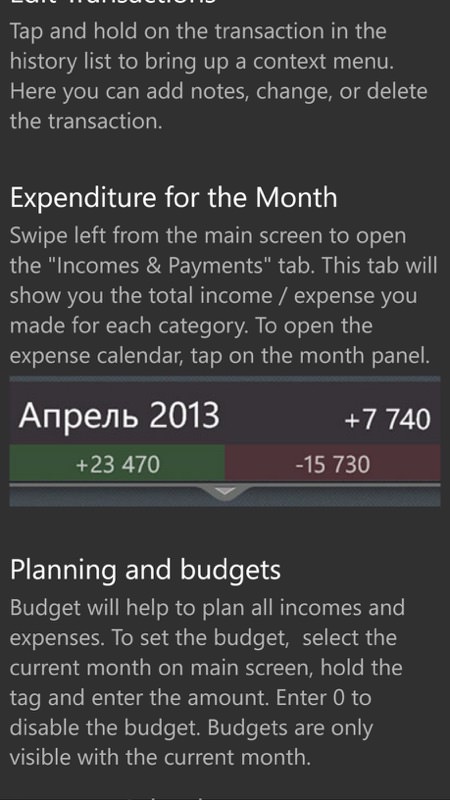

The illustrated help system does a good job of showing what's possible if you really get into entering all your transactions - a colour-coded month indeed, showing 'where it all went wrong'!

A slick application then - but it's not enough. For a money management application to succeed, it has to be utterly comprehensive - and Monetal's not. It's possible I'm missing functions that are in the application somewhere, but in that case I'm blaming the developer. Some points of omission or confusion:

- there doesn't seem to be a way to schedule repeated credits (e.g salary) or debits (e.g. cable TV or broadband subscriptions).

- the six categories supplied (including 'Other') can't be added to and indeed 'Cat' and 'Debts' aren't at all obvious. What does the former mean? and what is meant by 'Debts'? I mean, I don't owe anyone anything and the suggested default is just 'My best friend'.

- planning a budget is mentioned in help but try as I might I couldn't find the magic rune or long press that activated the budget function.

Now it's entirely possible that some of the abbreviations and help text were 'lost in translation' - there are clues in the text that the developer's first language isn't English, but I'd argue that for a worldwide audience more testing, more polishing and a LOT more explanation and examples are needed if Monetal is to be shown off to best effect. When I wrote the aforementioned manual (for Palmtop Software's S5 Money for Psion, if anyone's interested), it was getting on for a hundred pages long. Not because the software itself was hard to use (it was a pleasure), but because so much education was needed for a user to get the most out of it.

There's a genuinely good user interface here that's worth refining and an application that could, in the future, be held up as an example of what could be done on Windows Phone. Could.

And even with the extra potential development, there's still that nagging doubt that in 2015 I'm not at all sure that many people want to micro-manage a mirror image of their financial state when they can refer to and deal with the live data instead.

PS. On the positive side, in the app description is "It's charged with positive energy and attracts wealth" - so err... maybe you'd both feel good and make back the £8 purchase price in short order! [and yes, there's a trial version]

Reviewed by Steve Litchfield at